DOGE Price Prediction: Analyzing the Path to Potential 500% Gains Amid Current Market Volatility

#DOGE

- Current oversold technical conditions suggest potential near-term rebound opportunities

- Macroeconomic inflation concerns creating broad crypto market headwinds

- Divergent analyst predictions indicate high volatility potential with significant upside in next market cycle

DOGE Price Prediction

Technical Analysis: DOGE Shows Oversold Conditions with Potential Rebound Signals

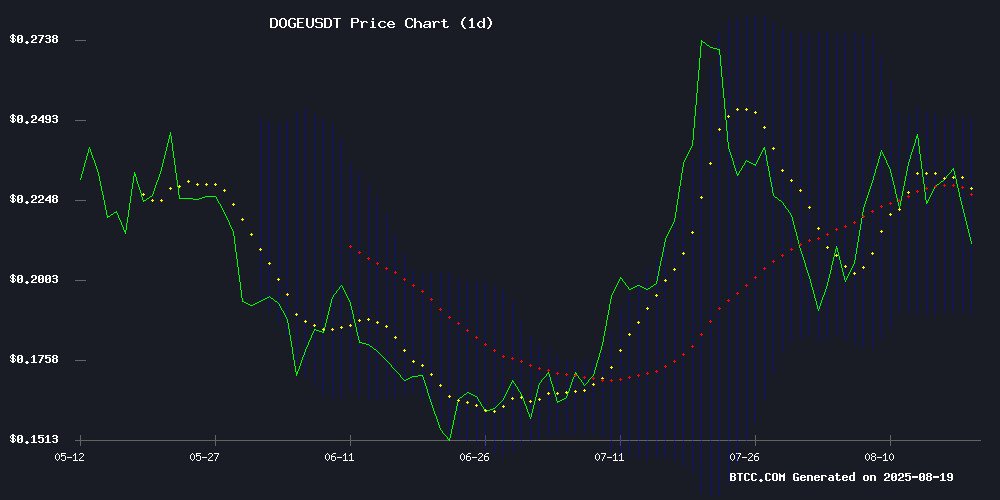

DOGE is currently trading at $0.2136, below its 20-day moving average of $0.21998, indicating short-term bearish pressure. The MACD reading of -0.010378 suggests ongoing downward momentum, though the histogram shows some convergence. Bollinger Bands position the price NEAR the lower band at $0.18989, which often serves as a support level in oversold conditions. According to BTCC financial analyst Olivia, 'The current technical setup suggests DOGE is testing key support levels. A bounce from these levels could trigger a retest of the middle Bollinger Band around $0.22.'

Market Sentiment: Mixed Signals Amid Broad Crypto Sell-Off

Current market sentiment reflects caution as Dogecoin experiences selling pressure alongside broader cryptocurrency weakness driven by inflation concerns. While negative headlines dominate short-term sentiment, analyst predictions show significant divergence in long-term outlooks. BTCC financial analyst Olivia notes, 'The contrast between immediate market liquidations and optimistic long-term projections creates a complex sentiment landscape. Current volatility may present entry opportunities for patient investors, but risk management remains crucial during this period of macroeconomic uncertainty.'

Factors Influencing DOGE's Price

Dogecoin Slides Amid Broad Crypto Sell-Off Triggered by Inflation Concerns

Dogecoin (DOGE) fell 3.7% in 24-hour trading, underperforming the broader cryptocurrency market's downturn. The meme coin's decline mirrors sector-wide bearish sentiment sparked by Home Depot's Q2 earnings report.

The home improvement giant's warning about impending price hikes due to tariff-related cost pressures has reignited inflation fears. This macroeconomic concern appears to be driving capital out of risk assets, with cryptocurrencies bearing particular brunt of the sell-off.

Market participants are interpreting Home Depot's pricing strategy as a leading indicator of renewed inflationary pressures. Such conditions traditionally dampen appetite for speculative assets, creating headwinds for Doge and other altcoins.

Dogecoin Tests Key Support Amid Market-Wide Liquidations

Dogecoin plunged overnight, shedding 4% to test the $0.22 support level as $782 million in trading volume triggered a cascade of stop-loss orders. The sell-off mirrored broader crypto market weakness, with over $1 billion in liquidations following hotter-than-expected U.S. inflation data that dampened expectations for Federal Reserve rate cuts.

Despite the downturn, institutional investors accumulated 2 billion DOGE worth $500 million this week, bringing total reported holdings to 27.6 billion tokens. The $0.22 level now emerges as critical short-term support, while resistance consolidates NEAR $0.23 where profit-taking persists.

The breakdown invalidates Dogecoin's previous bullish structure, with the 782 million DOGE volume spike confirming capitulation. A late-session rebound attempt suggests some demand at current levels, though macro pressures continue to weigh on sentiment across digital assets.

Where Will Dogecoin Be in 5 Years?

Dogecoin (DOGE), once a niche meme coin, has cemented its place among the top 10 cryptocurrencies by market cap. Its journey from internet joke to mainstream asset—endorsed by figures like Elon Musk and recognized even by non-crypto audiences—highlights its unpredictable yet resilient trajectory. The 2021 bull run and post-2024 election surge underscore its volatility and meme-driven appeal.

Technologically, Dogecoin lags behind newer blockchains. With transaction fees under $0.10 and a throughput of 30 transactions per second, it struggles to compete with faster, cheaper alternatives. Yet its simplicity and brand recognition sustain relevance. The next five years hinge on broader crypto adoption and whether DOGE can evolve beyond its speculative roots.

Right Time to Enter DOGE? Analyst Suggests Unilabs as Lower-Risk Entry in Current Volatility

Dogecoin is back in the spotlight as institutional moves reshape crypto market sentiment. Grayscale's recent filing for a DOGE ETF sparked a 2.5% price surge, breaking weeks of stagnation. The memecoin has gained 14.65% over the past month, demonstrating its enduring retail appeal.

Analysts caution that DOGE's momentum often rides on fleeting hype, leaving traders vulnerable to sharp reversals. While the Grayscale proposal fuels speculation, its ultimate fate rests with SEC approval—a process known for creating volatility.

Amid this uncertainty, Unilabs emerges as a stabilizing force. The AI-powered DeFi platform, now managing $30M in assets, offers structured opportunities through its live presale. Market experts increasingly view such managed solutions as prudent alternatives to meme coin gambling.

Analyst Predicts 500% Parabolic Rally for Dogecoin in Coming Market Cycle

Dogecoin, the meme-inspired cryptocurrency, may be on the verge of another explosive rally, according to analyst Cryptoinsightuk. A 500% surge from current levels is framed as a realistic scenario, given DOGE's historical tendency for compressed, violent upside moves. The asset remains a top-10 laggard that hasn't yet printed a new all-time high this cycle—a setup that has previously preceded its most dramatic advances.

Technical analysis reveals a potentially bullish inflection point. Monthly RSI approaches a critical cross while the coin has twice tested oversold territory. "The majority of Doge's MOVE happens in like two different monthly pops," notes the analyst, referencing prior cycles where 600-700% surges were followed by secondary 500% legs. This cycle's largest single-month gain of 150% appears modest by comparison.

How High Will DOGE Price Go?

Based on current technical indicators and market sentiment analysis, DOGE shows potential for significant movement in both directions. In the near term, resistance levels to watch include the 20-day MA at $0.22 and the upper Bollinger Band at $0.25. Analyst predictions vary widely, with some suggesting potential for 500% gains in the next market cycle, though this would require broader crypto market recovery and reduced inflation concerns.

| Timeframe | Potential Price Range | Key Factors |

|---|---|---|

| Short-term (1-3 months) | $0.19 - $0.28 | Technical support/resistance, market sentiment |

| Medium-term (6-12 months) | $0.15 - $0.45 | Macroeconomic conditions, adoption trends |

| Long-term (3-5 years) | $0.50 - $1.50+ | Market cycle development, ecosystem growth |